The recent surge occurred amid signs of a shortage in the London market.

The price of platinum has reached a historic high, surpassing $2300 per ounce for the first time, amid limited supply and historically high borrowing costs. This is reported by Bloomberg.

The metal has risen for the 10th consecutive session. This is the longest streak of gains since 2017. Since the beginning of the year, the price has increased by more than 150%, marking the most significant annual gain since Bloomberg began collecting data in 1987.

The recent surge occurred amid signs of a shortage in the London market, while banks are placing the metal in the U.S., hedging against the risks of tariffs.

Platinum, used in the automotive and jewelry industries, has caught the overall wave of investment demand for precious metals this year.

Gold and silver have also reached new records.

U.S. warehouses have accumulated over 600,000 ounces of platinum — significantly more than the usual volume. Traders are awaiting the results of Washington's investigation under Section 232 (Trade Expansion Act), which could lead to tariffs or trade restrictions on the metal.

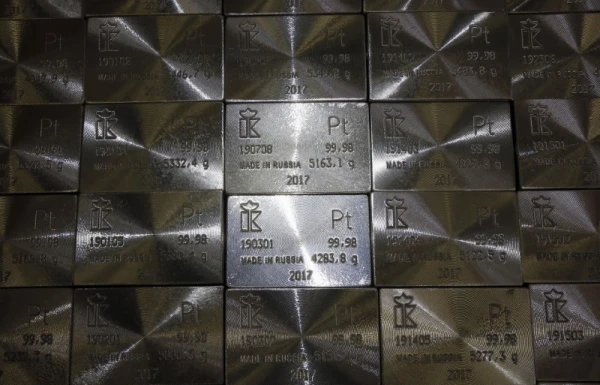

Global platinum production is concentrated in a few countries, with South Africa leading (about 70-80% of global production), followed by Russia (often as a byproduct of nickel mining) and to a lesser extent Zimbabwe, Canada, and the U.S. Major reserves are located in South Africa (Bushveld Complex) and Russia (Norilsk region), where platinum is mined alongside copper and nickel.

Leave a comment