Exporters have benefited in several ways.

Experiencing a new wave of trade pressure from the United States, Latin America was bracing for a serious blow to its economy. However, the impact of Donald Trump's tariff policy turned out to be unexpectedly mild for the region: the economy not only did not weaken but emerged from a turbulent period, as they say, 'on horseback.'

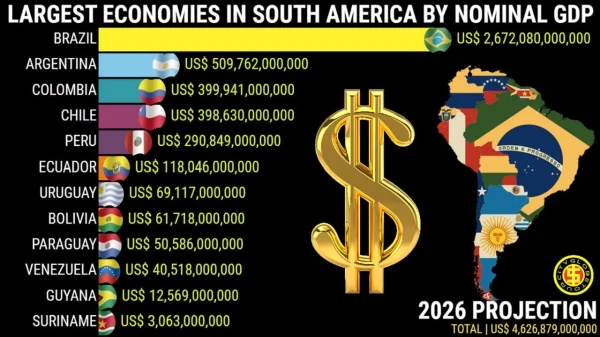

According to Bloomberg, over the past twelve months, exports from the countries in the region have significantly increased. The volume of Argentina's foreign shipments last year was the second largest in the country's history. Similar record figures for 2025 are being recorded in Brazil and Chile.

Mexico and Peru are also close to renewing their own export highs. The recovery occurred due to high global demand for raw materials and the redistribution of trade flows in favor of countries less dependent on American tariff restrictions.

These data show that Latin America's dependence on the U.S. market has decreased compared to previous trade cycles. The main, and for some countries, the second most important market has become China, which has provided Latin America with more stable demand.

While Europe is once again scratching its head over what to do with the latest tariff threats from Donald Trump, Latin America enters 2026 in a more stable and advantageous position. It turns out that the region was better prepared for possible trade shocks.

Exporters have benefited in several ways: through improved logistics, the ability to quickly redirect supplies to emerging markets, and primarily due to strengthened trade ties with China. The world's second-largest economy is actively increasing purchases of key raw materials from the region — soybeans, copper, and iron ore.

'Last year's strong export figures seem paradoxical against the backdrop of tariff pressure, but they are the result of a combination of rising prices, increased supply volumes, and geopolitical factors,' noted Andres Abadia, chief economist for Latin America at Pantheon Macroeconomics. In his assessment, the main export positions of the region will maintain relative stability in the future.

Latin America has found itself at the center of global geopolitics due to the rather aggressive attempts by the Trump administration to strengthen U.S. influence in the Western Hemisphere. However, in trade and economic terms, the reality is different: in most countries of the region, China has today strengthened its position more than ever before.

In 2025, this shift was particularly evident in the food and agricultural sectors. China's desire to diversify its sources of imports led to a sharp increase in shipments of frozen Brazilian beef — nearly 50% compared to the previous year.

Due to trade conflicts between the U.S. and China, shipments of American soybeans have significantly decreased, and Argentina has taken advantage of this. In September, it lifted export duties on this agricultural product. As a result, China increased its purchases of Argentine soybeans, and these shipments partially replaced the volumes that previously came from the U.S.

In Peru, the key factor for export growth has been Chinese demand for gold and copper. This clearly shows how China's demand for industrial raw materials and materials for green energy is increasingly shifting Latin America's trade towards Beijing.

'There is a global confrontation between the U.S. and China, and both countries are vying for markets,' said Alberto Ramos, chief economist for Latin America at Goldman Sachs Group Inc. 'But China is already a significant trading partner for most economies in the region.'

The only exception remains Mexico: about 80% of its exports are still directed to the U.S., and shipments to the North American market have increased by 7%. Additionally, at the end of November, the government of Claudia Sheinbaum imposed tariffs on 1,463 goods, primarily Chinese, signaling even closer coordination with Washington.

Chile sold record volumes of copper — a key metal for new energy. Shipments went to both China and the U.S., but high demand and soaring prices played a significant role here.

In the future, the exports of Brazil, Chile, Colombia, Mexico, and Peru will also be supported by demand for raw materials and agricultural products, believes Abadia from Pantheon Macroeconomics.

Brazilian authorities expect exports this year to range from $340 billion to $380 billion. In 2025, it was $348.7 billion. The Central Bank of Chile forecasts a 1.8% increase in the export of goods and services. In Argentina, according to the central bank, exports this year will grow from $87.1 billion to $91.4 billion.

In this situation, regional leaders are trying to maintain balance. Even Argentina, led by Javier Milei, a close ally of Trump, continues to look to China as a key market and avoids an open break with Beijing.

Leftist Brazilian President Luiz Inácio Lula da Silva also prefers to act cautiously and avoid escalations. A fragile peace has been established between the U.S. and Brazil after Lula da Silva managed to achieve the cancellation of a significant portion of the tariffs imposed by Donald Trump in 2025.

'Recent steps by Trump have shown that the U.S. is ready to support politically aligned governments in the region,' notes Standard Chartered economist Dan Pan. 'But even the most right-wing leaders in Latin America are forced to be pragmatists when it comes to the largest buyers of their export goods.'

Leave a comment