The company produces about 2% of the world's oil, including production both in Russia and abroad.

Investment giant Carlyle is considering the acquisition of overseas assets of the Russian oil company Lukoil, three sources familiar with the situation told Reuters. According to the agency, the American fund is currently in the early stages of exploring the issue and is considering applying for a license in the U.S. that would allow it to complete the transaction and conduct a comprehensive asset review.

One of the sources noted that the company has informed Lukoil of its interest, but has not yet made a final decision and may back out of the purchase.

Washington previously imposed sanctions on Lukoil as part of efforts to pressure the Kremlin to end the war in Ukraine. Additionally, the U.S. prevented the company from selling part of its overseas assets to Swiss trader Gunvor, which is linked to Vladimir Putin's friend Gennady Timchenko.

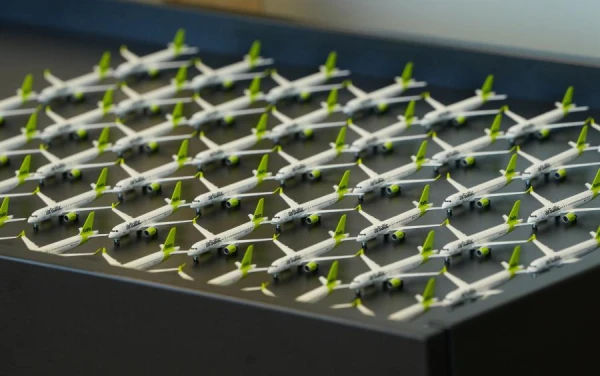

Lukoil produces about 2% of the world's oil, including production both in Russia and abroad. The company has already announced it is seeking buyers for its international assets, which account for more than 0.5% of global oil production and are valued at approximately $22 billion as of 2024. For decades, Lukoil has remained the most active Russian oil player abroad, demonstrating Moscow's "soft economic power," the agency notes.

According to Reuters, Lukoil owns three refineries in Europe, stakes in fields in Kazakhstan, Uzbekistan, Iraq, Mexico, Ghana, Egypt, and Nigeria, as well as hundreds of gas stations worldwide, including in the United States.

Carlyle Group is one of the largest structures in the world in the fields of private equity, asset management, and financial services. According to the agency, Carlyle manages assets worth $474 billion.

Leave a comment