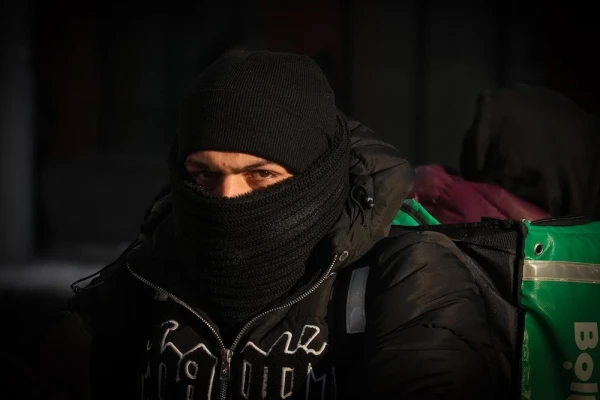

An expert on the TV-3 portal discusses the problems in the business lending sector.

The growth of the Latvian economy is unthinkable without capital; however, lending remains one of the most painful issues for young and growing enterprises. This is openly stated by the Chairperson of the Board of the Latvian Chamber of Commerce and Industry (LCCI) Katrina Zariņa in a podcast on the portal "tv3.lv," explaining what the real situation is from the entrepreneurs' perspective and what still needs to be changed.

According to official data, lending volumes in Latvia are growing — both for households and enterprises. But, as Zariņa emphasizes, this does not yet mean that banks have suddenly become much more open to new ideas. "The question is whether banks are indeed lending more, or if enterprises have simply pulled out projects that were postponed during the crises?!" says Zariņa.

She admits that some entrepreneurs were waiting with investments during COVID-19 and high interest rates, hoping for a more stable period. Now, as rates are no longer rising rapidly, projects are gradually returning to the agenda.

Despite the signals of growth, entrepreneurs remain cautious. One of the main stumbling blocks is high interest rates and banks' requirements for personal collateral. "In many cases, this means that an entrepreneur must pledge not only the enterprise but also their personal property," explained Zariņa.

Although not always, banks often require personal guarantees even in the case of limited liability companies. This makes many entrepreneurs think twice. "If you already have a sufficiently stable, moderately successful enterprise, the question arises — why risk your personal safety?!" noted the head of the LCCI.

Leave a comment