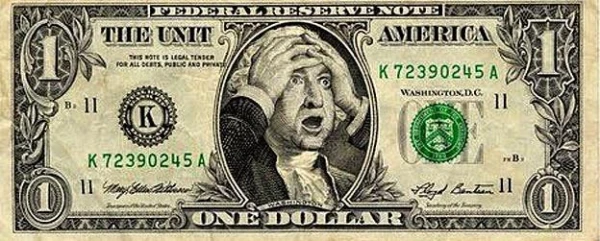

The U.S. dollar is experiencing its largest annual decline since 2017. Wall Street bankers predict that the American currency will remain weak next year as the Federal Reserve continues to cut interest rates.

The Financial Times reports that this year the "greenback" fell by 9.5% against a basket of major currencies after U.S. President Donald Trump's trade war raised concerns about the prospects of the world's largest economy and called into question the dollar's traditional status as a safe asset for investors.

The euro showed the largest gain among major currencies against the weakened dollar, soaring nearly 14% to over $1.17 - a level last seen in 2021.

"This is one of the worst years for the dollar in the history of floating exchange rates," noted George Saravelos, who researches currency markets at Deutsche Bank.

As previously mentioned, the dollar's decline was influenced by Trump's imposition of aggressive tariffs against U.S. trading partners in April. At one point, it fell by 15% against major currencies. The Federal Reserve's resumption of rate cuts in September intensified the pressure on the dollar.

Experts believe that the Fed's rate cuts could lead to a further decline in the dollar's value in 2026. Wall Street banks predict that the euro will strengthen to $1.20 by the end of 2026, while the pound will rise from its current level of $1.33 to $1.36.

The state of the dollar, which remains the leading global currency, affects companies, investors, and central banks. Its weakness has been beneficial for American exporters but has created difficulties for many European companies that earn revenue from sales in the U.S.

Analysts say that the dollar's exchange rate in 2026 will depend on Trump's candidate for the chair of the Federal Reserve. Its further decline is more likely if the central bank head is inclined to comply with the White House's demands for deeper rate cuts.

Despite the dollar's decline, experts are optimistic about the prospects for the U.S. economy. They believe that the boom in artificial intelligence investments will ensure faster growth for the American economy compared to Europe next year.

"We do not believe that President Trump's economic policies can derail the technological revolution taking place on the West Coast of America," says currency strategist at Société Générale, Kit Jacks.

Leave a comment