Against the backdrop of the turbulent budget approval, the work of the country's main financial institution has somehow taken a back seat. And in general, in recent years, the Bank of Latvia does not seem to be such a newsmaker as it was during the transition to the Latvian ruble, lat, and euro.

Nevertheless, the central bank of Latvia considers itself innovative and efficient; providing a reliable and crisis-resistant financial sector. The latter leads to modern and accessible services. All these formulations are from the official report of the Bank of Latvia.

European Leaders

Targeted inflation is a monetary policy regime in which the central bank publicly forecasts the level of price growth. In Latvia, according to the Bank of Latvia, this is half ensured by food products, stemming from a lack of competition and efficiency.

Therefore, despite all the efforts of Martiņš Kazaks' institution, inflation in October in our country was 3.8% per annum, significantly exceeding both the eurozone level of 2.2% and the European Central Bank's overnight deposit rate of 2%.

Interestingly, over the past 2 years, European inflation has been steadily declining – from 3% at the end of 2023. Latvian inflation, starting from a very moderate 1%, overtook the Union about a year ago and has only crawled upwards since then. Of course, these are not the extreme, double-digit levels of the COVID era and the beginning of the war in Eastern Europe, but nevertheless, the tension is felt by everyone – both consumers and businesses. And the Bank of Latvia remains calm.

– Raising interest rates due to one sector that has structural problems means driving the rest of the economy into recession, – said M. Kazaks to the members of the Budget and Finance (Tax) Committee, who gathered for the second annual report of the Bank of Latvia chaired by Anda Čakša (New Unity).

"This would not be the best solution," characterized the potential rise in interest rates the head of the Bank of Latvia, noting that he intends to follow the general policy of the ECB, which will determine the rates in the eurozone at a meeting this week.

How to Curb Prices

– The best way to reduce inflation is through greater competition, – postulates M. Kazaks. – From both producers and sellers. And we see the activity of the Ministry of Economics in this area. Gradually, it seems, this is starting to bear fruit. We, for our part, help more with our analysis and possible support for decisions.

"This is not only a matter of food prices, but also of wage increases, which have been and remain consistently rapid, – emphasized the president of the Bank of Latvia. – If it is not followed by productivity, it increases inflation. We see this in the rise in service prices."

Similarly, M. Kazaks noted that administratively regulated prices are also increasing in Latvia: – From our side, there is a question – is this always justified? Not always…

"We are the leaders of the region"

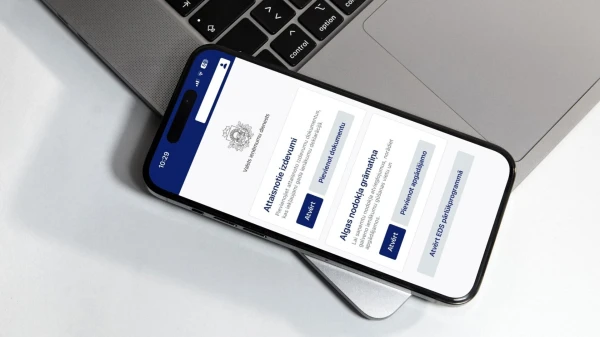

The year 2025, according to bankers, will be marked as the "breakthrough year in critical financial services."

– This is very important for security; Lithuanians and Estonians learn from us, – boasted the president of the central bank. The offline limit in our country is 200 euros, so to speak, for a rainy day.

What does this mean? The country ensures acceptance of card payments without internet access – in large retail chains, at gas stations, and in pharmacies. That is, if the enemy cuts off the internet, life will not stop – with 200 euros, one can buy food, medicine, and gasoline.

Testing of the continuity of financial services has been conducted – through ATM networks, as well as settlements between large enterprises. Information was provided to the public – "what you need to know about money in a crisis situation."

As of January 1, 2025, requirements for the availability of a minimum amount of cash have been implemented; as of October 5, verification of payment recipients has been introduced; events are constantly held to strengthen "digital resilience" and detect cyber risks. All this is done "considering the geopolitical situation," M. Kazaks noted significantly.

What About Lending?

According to the Bank of Latvia, lending "is becoming a driving force for economic growth." This is quite an optimistic view when comparing the curves of outstanding loans as a share of GDP in eurozone countries and Latvia. In 2009, we were indeed fully at the level of the rest of Europe – loans were issued at 100% of the gross domestic product. Those years M. Kazaks critically assesses: "A bubble."

Then, as the economic crisis cooled, we experienced a constant decline: in 2012, lending was 66.1% of GDP, in 2017 – 42.8%, in 2023 – 28.2%. After the harshest financial crisis in modern history, people were afraid to borrow, and banks, turning into pawnshops, were afraid to lend without solid collateral.

Over the past year and a half, a slight increase has been noted – in the second quarter of 2025, the share of loans exceeded 30%, thus reaching "pre-war" levels.

In any case, this is more than twice lower than at the same time in the eurozone – 73.4%. However, the Bank of Latvia has identified a positive trend in the predominance of loans for non-financial enterprises over household lending. Moreover, the share of long-term liabilities (over 5 years) has increased significantly by 16.7%.

Have You Tried Lowering Rates?

If we discuss the "favorite" topic of the interest rate, it has decreased in Latvia, although, as the Bank of Latvia notes, "it is still above the average level of the eurozone."

Meanwhile, a 1% decrease in the mortgage rate (on average, M. Kazaks noted, it is taken in Latvia for 20 years) allows one to additionally acquire as much as 6 square meters in a new project building or 18 square meters in the secondary market of Soviet "series" apartments.

The Bank of Latvia takes credit for reducing the credit burden for 11,000 mortgage borrowers, resulting in a total savings of 50,000,000 euros for the country. Thus, the average household saved (and banks lost) about 350 euros over the year.

How to increase lending in Latvia? The Bank of Latvia sees several directions:

- Easing the refinancing of legal entities;

- Lifting restrictions on advertising lending in general;

- Promoting financial literacy among enterprises;

- A diverse financial sector – a stronger economy.

Elaborating on the last point, it can be noted that the Bank of Latvia is paying attention to the non-banking sector – it is planned to issue specialized credit licenses, which should ensure greater trust from clients. The central bank is also striving for securitization – i.e., the issuance of securities backed by loans to non-banking enterprises.

Pension Funds Have a Say

"A million profit for society" – this is how the Bank of Latvia glorified the process of our pensioners' money entering the financial market. Managers of second-level pensions were given the opportunity last year to save about 2.8 million euros by lowering the ceilings on commission payments. To promote a more active play with pension savings, the limits on second-level deposits have been revised. With the assistance of the Ministry of Welfare, the Ministry of Finance, and the State Social Insurance Agency, "a solution has been developed that provides flexibility for people reaching retirement age."

Overall, the Bank of Latvia is satisfied with the initiated reform of managing the 2nd and 3rd pension levels. Everyone is encouraged to monitor their savings on the portal manapensija.lv!

The Vice President of the Bank of Latvia, Santa Purgāle, promises greater flexibility in the pension sector next year, a reduction in bureaucracy, and interaction with the financial sector.

Leave a comment