Investors who invested $1000 in the meme coin Doge in 2021 earned over $100,000. Created by Billy Markus and Jackson Palmer as a fun experiment nine years earlier, Dogecoin sharply rose about 160 times and even entered the top 5 cryptocurrencies by market capitalization. This growth was partly triggered by Elon Musk, whose posts have repeatedly changed the token's price in just a few minutes since then.

Shiba Inu became the next example of how memes open up more opportunities for market participants. The token positioned itself as the "Dogecoin killer" and at its peak was on par with leading altcoins in terms of market valuation. Its trading volume during peak periods was comparable to Ethereum, and mass marketing along with the cult of the Shiba Inu dog made the coin one of the symbols of 2021–2022. Floki Inu solidified the trend and showed that the demand for such assets does not fade but only redistributes among market participants.

By 2025, meme coins have formed a separate sector with a combined capitalization in the tens of billions of dollars. Their difference from traditional types of cryptocurrency is obvious: the former usually develop through smart contracts, integration into fintech, and the real economy, while the latter initially rely on the attention of supporters and cultural codes.

Of course, meme coins remain extremely volatile. Their value can skyrocket due to any, even the most trivial, news event, such as a viral joke post, especially from celebrities. For example, Elon Musk still acts as a catalyst for certain cryptocurrencies, and Donald Trump's political rhetoric recently triggered the launch of the $TRUMP token. This is precisely what attracts risk lovers, for whom the speed of reaction and the ability to get in before others is the main source of profit.

Currently, dozens of meme tokens are entering the market, each claiming to be the "next Dogecoin." But history shows that only a few become sustainable, while the rest disappear along with the waning interest of followers.

Thus, the balance between empty hype and real value becomes a defining factor for investors when choosing an asset for investment. In the following sections, we will analyze what features truly help meme coins maintain capitalization and attention, as well as why new players claim to be the next big story.

New Meme Coins of 2025: Hype + Utility

By 2025, new participants in the meme coin sector are emerging, leveraging the power of memes but offering more than just hype. While Dogecoin and Shiba Inu were built on virality, fresh launches are trying to combine audience attention with a well-thought-out economy. In this context, Maxi Doge and Snorter stand out: the former bets on aggressive trading and price support mechanisms, while the latter focuses on a product that helps find investment opportunities at an early stage.

Maxi Doge: A Meme Coin with Thoughtful Tokenomics

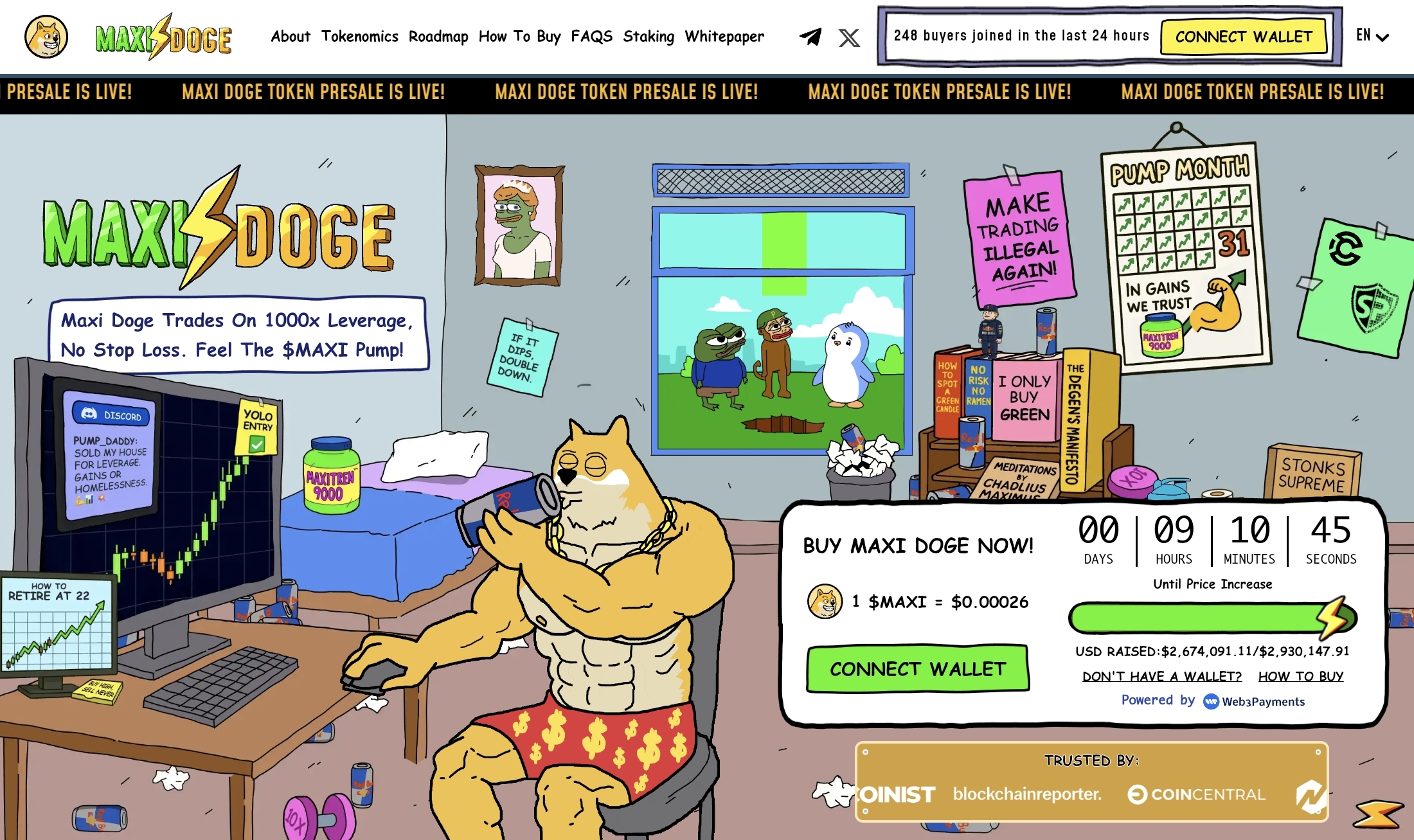

The concept of Maxi Doge is based on the image of the "buffed Doge," symbolizing risk and the willingness to go all the way.

Unlike older players like Dogecoin or Shiba Inu, the product from the very start emphasizes not only its meme origin but also its tokenomics, with the main goal of forming a community with long-term engagement. 40% of the raised funds are allocated for marketing, and another 25% goes to a fund for price support and partnership initiatives.

Over $2.5 million has been raised in the presale at a price of $MAXI at $0.0002595. Token holders can participate in staking with returns of up to 133% per annum. The security of the smart contracts is confirmed by audits from Coinsult and SOLIDProof.

A separate part of the philosophy is related to leveraged trading and the idea of "all or nothing": most such trades result in losses, but one successful entry often outweighs a whole series of failures. This risky approach resonates with enthusiasts who seek maximum returns and are willing to tolerate high volatility.

Maxi Doge combines the meme image with aggressive economics, offering users a mix of hype, high returns, and a risk philosophy.

Snorter: A Tool for Token Trading

Snorter is a trading Telegram bot that gives investors an edge: the ability to enter tokens at the moment they appear.

The bot connects to meme pools on Solana and Ethereum and tracks the emergence of contracts in real time. To reduce risks, it includes verification and anti-scam filtering: the system filters out thousands of unreliable launches and highlights only those that meet basic criteria.

The ecosystem includes copy trading: users can automatically replicate the trades of more experienced participants. This approach makes the service useful for newcomers who want to trade but have not yet fully understood the intricacies.

The economy of Snorter revolves around the $SNORT token. Its holders benefit from reduced fees: 0.85% per trade compared to 1.5-2% with competitors, as well as unlimited access to "snipes" and advanced analytics. The token is used in staking with returns of up to 114% per annum and grants voting rights in the platform's development. Currently, the price of $SNORT is $0.1063, and the presale has raised $4.1 million.

The mascot of Snorter is the aardvark, which "sniffs out" rare finds. This image emphasizes the main task of the bot — finding promising tokens among dozens of similar meme coins.

LEARN MORE ABOUT THE SNORTER BOT

From Memes to Billions: The Cultural Code of Meme Coins

Current statistics indicate that over 65% of meme coins lose more than 90% of their value within the first six months of existence, but the remaining ones can drive the market with a capitalization of tens of billions of dollars. This imbalance encapsulates the essence of the segment: most assets rely on virality and quickly lose community engagement. Only a few players build a sustainable community around themselves and add economics or technology to maintain long-term interest.

The life cycle of such an asset usually follows this pattern: a meme is born → attracts attention → capitalization grows → hype fades → price falls. This cyclicality makes the sector risky, but it also supports its dynamics: old meme coins lose relevance, while new ones emerge, hunted by crypto enthusiasts.

The main catalyst for mass adoption has been the Pump.fun platform on Solana. It has turned the launch of meme coins into an element of a digital game: any user can issue a token in a matter of minutes. This has made creating a meme coin as easy as posting a meme on social media, spawning millions of new projects. The mass nature of the segment is not a side effect but its essence.

Another feature of meme coins is that their symbolism has ceased to be limited to funny pictures of Shiba Inu dogs. Now, sources of inspiration also include politics and social events. In 2025, the $TRUMP token was launched on Solana, associated with Donald Trump. In just a few weeks, it raised tens of millions of dollars in fees, proving that meme coins can reflect not only meme culture but also the global agenda.

Thus, the cultural code of meme coins consists of three factors: the accessibility of launching (Pump.fun), the expansion of themes beyond classic images (from dogs to politicians), and the viral nature that simultaneously generates explosive growth and predetermines rapid decline. This makes the sector unique: it does not resemble traditional cryptocurrencies and yet remains one of the most paradoxical phenomena in the industry.

How to Choose a Meme Coin to Avoid Losing Money

As mentioned earlier, a significant portion of meme assets loses almost all their value within the first months after launch. Therefore, before investing, it is important to assess a number of basic parameters that indicate whether a token can sustain itself in the crypto world.

1. Smart Contract Conditions.

Some projects embed hidden mechanisms in the code: impossibility of selling or excessive fees for withdrawal. This was the case with the Squid Game Token: investors could only buy the token but had no technical means to sell it. After that, the team withdrew liquidity from the pool — the funds that ensured the token's exchange. As a result, the token ceased to have value, and buyers lost their money. Independent auditors, such as Coinsult or SOLIDProof, help verify the code.

2. Exchange Access and Liquidity.

It is safer to choose solutions that have turnover on several major platforms. Presence on centralized exchanges (Binance, OKX, KuCoin) or at least on popular decentralized ones (Uniswap, PancakeSwap, Raydium) increases the chances of stability. If a token is traded only in one pool with minimal volumes, it will be difficult for the holder to sell the asset at a fair price even with a slight decline. For example, $PEPE quickly received a listing on Binance in 2023, which provided it with liquidity and increased retail interest.

3. Token Distribution Structure.

A key question to find out when choosing a meme coin for investment is: who holds the majority of the assets. If a large portion of the supply is controlled by a few wallets, they can crash the prices with one move. In more thoughtful models, funds are distributed among marketing, support funds, and a wide range of holders. An example is Maxi Doge, where a significant portion of the budget is allocated for marketing and price stabilization, reducing dependence on the actions of individual players.

4. Transparency of the Roadmap and Team Behavior.

A responsible team publishes clear development plans, regularly reports on completed steps, and maintains open communication channels on social media. A lack of information or prolonged silence from developers often means that the initiative will cease to exist immediately after raising funds. A telling example is SafeMoon. The team long concealed issues with liquidity and communication. Against the backdrop of declining trust, the token's price plummeted by more than 90%, and a significant portion of its supporters was lost.

5. Community Activity

We have already mentioned that the strength of a meme coin is determined by audience activity. If interest is maintained only through contests and mass giveaways, it quickly fades. A sustainable community is formed when people create memes, write reviews, discuss the project, and regularly receive reasons to stay engaged. For this, the team must incorporate mechanisms into the strategy that sustain interest — from regular updates to events within the community.

Choosing a meme coin always involves risk, but it can be mitigated by checking the basic parameters we discussed above. For additional verification, services like Snorter are useful, as their functionality helps filter out projects with clear signs of scams right from the start.

Where the Meme Coin Market is Heading: Trends for 2025

Meme tokens are gradually ceasing to be exclusively instruments of short-term speculation. They are forming a full-fledged segment with their own laws and development directions. Several trends can now be identified that will determine the future movement of the industry.

Deepening into DeFi and GameFi

Some meme coins are becoming elements of broader ecosystems. Developers are increasingly launching them not as one-time experiments but as full-fledged products. For example, gamification-based solutions are emerging, where tokens are used for in-game operations: purchasing characters, items, or access to levels. In financial services, coins serve as an additional means of interaction with the platform, for example, granting participation rights in reward programs or allowing holders to receive bonuses. This means that meme coins can now retain value longer than usual, and their demand is formed not only through trading on exchanges.

Network Growth Hubs

Key platforms for meme coins are becoming Solana and Binance Smart Chain. These networks provide low fees and fast transaction processing, which is especially important for the mass segment. Notable projects still emerge on Ethereum, but the share of new ones is decreasing. Many teams are choosing a multi-chain strategy, meaning they launch a token across several networks at once. This reduces dependence on the infrastructure of a single blockchain and allows for faster audience engagement. For users, it is convenience; for projects, it is the ability to form liquidity more quickly.

Shortening Project Lifecycles

The active lifespan of the average meme coin is decreasing. While it used to remain in the spotlight for several months, the peak of interest is now often limited to just a few weeks. Automated token creation services and the spread of trends through social media have accelerated this process. For traders, this presents additional opportunities: early entry provides a chance for quick profits. But for long-term strategies, risks increase, as only a small portion of coins retain value after the first wave of interest.

In Conclusion

By 2025, meme coins have established themselves as a standalone segment but still remain a high-risk area. Their strength lies in the speed of audience reaction and cultural codes, references to which can instantly change prices. At the same time, modern projects strive to offer more than just a viral effect: some bet on thoughtful economics, like Maxi Doge, while others add service functionality, like Snorter.

The conclusion is clear: meme coins should not be treated like technological altcoins or Bitcoin. Here, the key indicators are constant selection and flexibility. Only a few survive, and they are the ones that generate turnover in billions of dollars. The rest quickly lose popularity. Therefore, the main guideline is not only the potential for growth but also the mechanisms for protecting finances: fund distribution, team transparency, and risk balance in the portfolio.