Comparing seniors' incomes is difficult due to differences in pension systems.

The highest pension amount is more than ten times greater than the lowest in Europe. Pensions are the main source of income for elderly people in Europe. About two-thirds of their income in the EU comes mainly from state pensions and benefits.

Despite this, people over 65 receive only about 86% of the average income of the entire population of 28 European countries.

According to OECD data, in the Baltic countries this figure drops below 70%, while in larger countries such as Belgium, Denmark, and Switzerland, it is below 80%.

To delve deeper into these comparisons, it is useful to look at the average gross annual old-age pension in the EU.

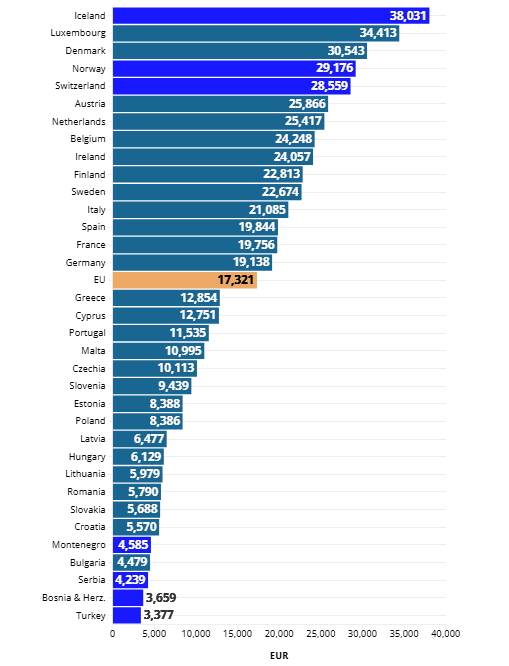

According to Eurostat, as of 2023, that amount in the EU is €17,321, or €1,443 per month before taxes.

Among 34 countries in Europe, the average annual pension ranges from €3,377 in Turkey to €38,031 in Iceland. Among EU members, this figure ranges from €4,479 in Bulgaria to €34,413 in Luxembourg.

At the bottom of the rankings, the average pension is also below €8,000 in Bosnia and Herzegovina, Serbia, Montenegro, Croatia, Slovakia, Romania, Lithuania, Hungary, and Latvia.

These figures show how greatly pensions vary: the highest pension amount is more than ten times greater than the lowest in Europe.

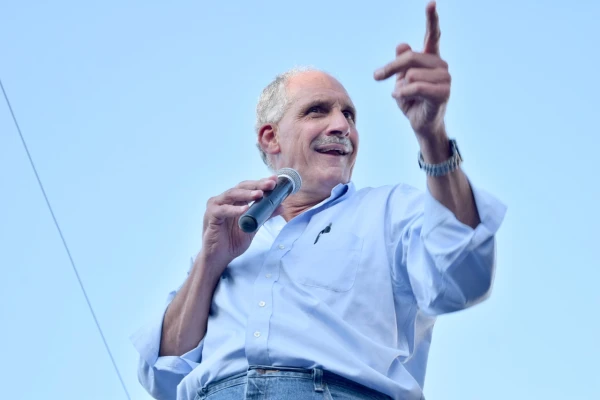

"Some EU countries are simply poorer than others, and families have to subsidize the pension income of elderly relatives and help them," Noel Whiteside, visiting professor at the University of Oxford, told Euronews Business.

The four largest economies in the EU are just above the average level in the European Union. The highest pension levels are noted in Italy, followed by Spain, France, and Germany.

"Comparing is difficult due to differences in pension systems," Philippe Seidel Leroy, policy manager at AGE Platform Europe, told Euronews Business.

In Germany, Spain, France, and Belgium, there are large state-funded redistributive pension systems, and much less extensive occupational systems covering only certain sectors or employers.

"Pension expenditures in these countries will be high on a per capita basis since the largest share of retirees' income comes from these legally established schemes," he added.

David Sinclair, executive director of the International Longevity Centre in the UK, emphasized that the pension architecture of each country is a significant factor determining the differences.

"These decisions, often driven by political compromises and historical legacies, explain why two countries with similar age structures can have completely different pension prices," he said in an interview with Euronews Business.

The differences become much smaller when measured in purchasing power standards (PPS), which reflect the cost of living. For one unit of PPS, the same amount of goods and services can be purchased in each country.

Old-age pensions in PPS range from 6,658 in Bosnia and Herzegovina to 22,187 in Luxembourg. The ratio of the highest to the lowest pension is only 3.3, whereas in nominal terms it exceeds 10.

Whiteside noted that in countries of the former Eastern Bloc, the remaining benefits for retirees—such as free healthcare, transportation, and subsidized housing—contribute to a higher PPS ratio. In other words, retirees get more for their money due to these social benefits.

Leave a comment