Despite the government's long-standing attention to the issue of the shadow economy, the current approach remains insufficiently effective, as the planned and implemented measures are largely aimed at addressing the consequences rather than the causes of its emergence, states the State Audit’s effectiveness audit on Latvia's approach to limiting the shadow economy, reports LETA.

According to the State Audit, the main tool for combating the shadow economy in Latvia is the Plan to Limit the Shadow Economy. In 2024, the implementation of the fourth plan for 2024–2027 began, with the goal of reducing the share of the shadow economy from 19.9% to 18.9% of the gross domestic product by 2027. However, the audit found that significant improvements are not anticipated.

The plan, in addition to general measures, identifies two priority sectors — construction and healthcare. Evaluating the justification for their selection, auditors concluded that the level of the shadow economy in healthcare is relatively low, while sectors with much higher levels of shadow are not included in the plan. In the construction sector, measures to limit the shadow economy have been implemented for a long time, and its volume has indeed decreased, but it still remains high. According to the auditors, the planned measures do not address the causes of the shadow economy in construction.

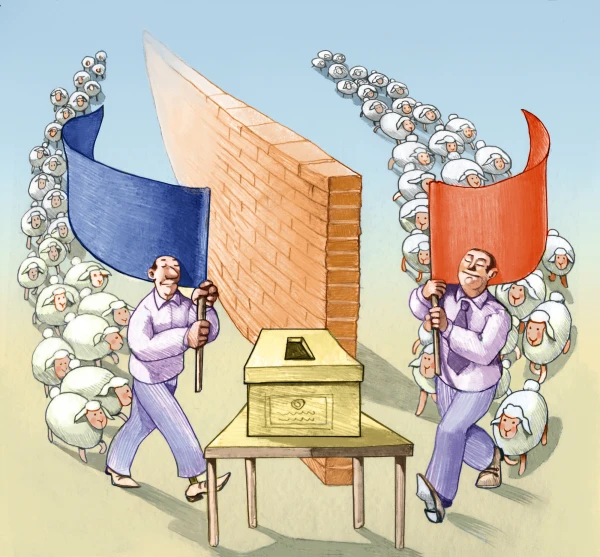

During the audit, 56 activities outlined in the plan were assessed in terms of their impact on reducing the shadow economy, bureaucracy, and administrative burden. It was found that most measures strengthen control mechanisms rather than prevent the emergence of the shadow economy. Auditors also note that the plan's content insufficiently utilizes scientific research to select the most effective solutions.

According to researchers, taxes are one of the main factors driving the shadow economy. Although the Ministry of Finance is working on the foundations of tax policy, Latvia still does not have a clear long-term development plan for it, the auditors emphasize. In the opinion of the State Audit, a predictable tax policy is a crucial condition for both economic development and reducing the shadow economy.

"While the state is making serious efforts to identify and, as expected, reduce bureaucracy and administrative burden, some activities in the plan to limit the shadow economy are directed in the opposite direction — towards strengthening requirements and control mechanisms. This is fighting the consequences, not the causes. Research shows that as wealth and trust increase, the shadow economy typically decreases," stated Inga Vilka, a member of the State Audit Council.

Auditors also emphasize that limiting the shadow economy is a horizontal policy involving many institutions. However, the audit showed that the institutional system is too complex, responsibility is blurred, and the focus is on processes rather than achieving specific results.

The State Audit points out that the Ministry of Finance plays a leading role in this issue, where a special structure was created to coordinate efforts to limit the shadow economy. According to the auditors, the expansion of the ministry's structure eight years ago with a new deputy secretary and department for limiting the shadow economy was disproportionate and irrational. Nevertheless, the audit notes that the structural changes made in April 2025 — returning to a unified responsibility for tax policy and managing the shadow economy — are a step towards rationalization, and this process should continue.

It is also emphasized that assessing the volume of the shadow economy is a complex task carried out using various methods. The latest available estimates in Latvia vary significantly: according to some data, the share of the shadow economy is about 7%, while according to others, it is slightly above 20% of GDP.

The audit showed that the Ministry of Finance uses the assessment of Austrian professor Friedrich Schneider (19.9% in 2022) as a performance indicator, while in communication with the public and politicians, it uses the shadow economy index of professors A. Sauka and T. Putniņš (21.4% in 2024). At the same time, data from the Central Statistical Bureau on the undeclared economy (6.7% in 2023) are not used. The State Audit emphasizes that this hinders an objective understanding and assessment of the situation and reduces trust in government data. Furthermore, dependence on individual studies complicates an objective long-term assessment of policy results.

The State Audit calls on the Ministry of Finance to reconsider the state approach to limiting the shadow economy, base decisions and communication on comprehensive and accessible long-term data, reduce bureaucracy, and focus on addressing the causes of the shadow economy.

Leave a comment