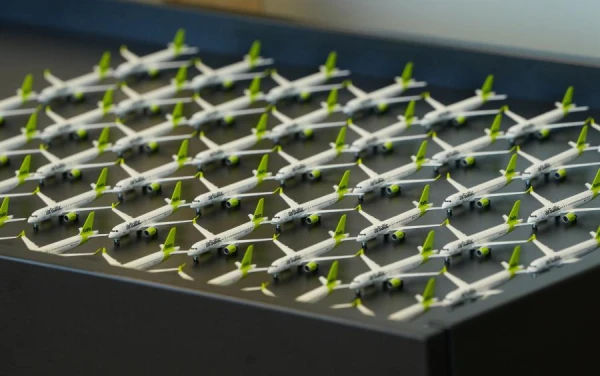

The Saeima Budget and Finance (Tax) Commission will review issues related to the management of the Latvian national airline airBaltic in the context of future development at a closed meeting on Tuesday, February 10, according to the agenda of the commission's meeting.

The meeting will begin at 10:00. Representatives from the Ministry of Transport, airBaltic, the Ministry of Finance, and the State Treasury have been invited.

As previously reported, Finance Minister Arvils Ašeradens (JV) acknowledged on Latvian television that, at this point, seeking investors for airBaltic is a more appropriate path than going public.

In response to a question about the timeline in which airBaltic needs to attract new financing in order to continue operations, the minister noted that "it seems this is a matter for the first half of the year, and we can only hope that it will happen."

He also indicated that the new head of airBaltic, Erno Hildens, appears convincing, pragmatic, and realistic, and that the company currently has a mandate to seek investors and is working in that direction.

It was previously reported that in the nine months of 2025, the airBaltic group achieved a turnover of €594.303 million and made a profit of €4.249 million.

At the same time, in 2024, the airBaltic group recorded audited losses of €118.159 million, in contrast to the profit made the previous year. However, the group's turnover increased by 11.9% compared to 2023, reaching €747.572 million.

At the end of August last year, Germany's national airline Lufthansa became a shareholder of airBaltic. Currently, the Latvian state owns 88.37% of airBaltic shares, Lufthansa owns 10%, financial investor Lars Tusens through Aircraft Leasing 1 owns 1.62%, and another 0.01% belongs to other shareholders. The company's share capital is €41.819 million.

After the initial public offering (IPO), Lufthansa's stake will be determined by the market price of the IPO. The deal also stipulates that after a potential IPO, Lufthansa will own at least 5% of airBaltic's capital.

On August 30, 2024, the Latvian government agreed that after the IPO, the state must retain at least 25% plus one share in airBaltic's capital. In turn, on August 19, 2025, the government decided that Latvia, like Lufthansa, will co-invest €14 million in airBaltic before a potential IPO.